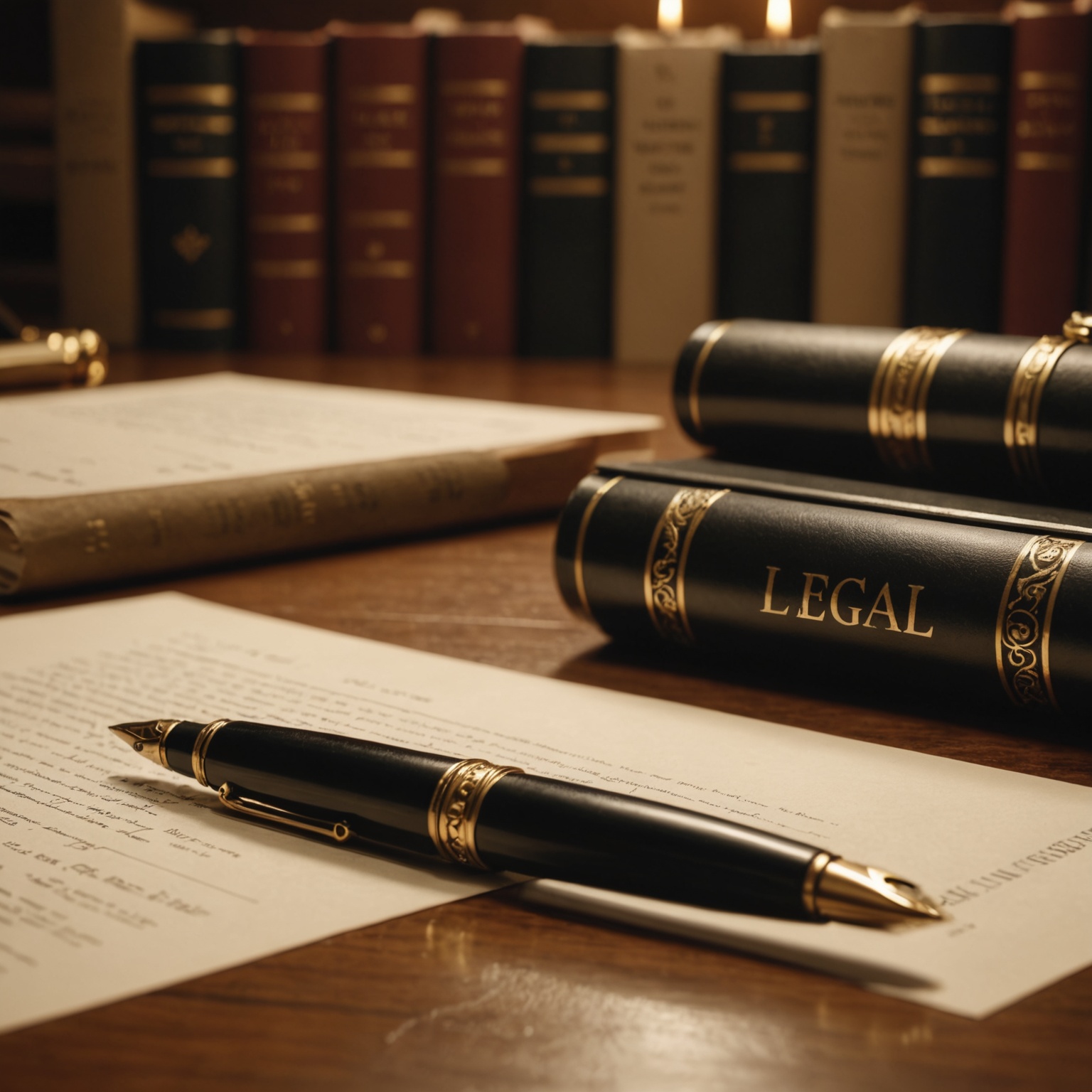

Is Your Legacy Protected?

Whether you’ve never created an estate plan or it’s been years since your last review, now is the time to act. The right estate plan honors your wishes, distributes assets smoothly and privately, minimizes taxes and costs, and preserves your control over healthcare and finances if you’re incapacitated.

For All your estate planning needs

How We Can Help?

Creation of a new estate plan from the ground up

Estate planning isn’t just for the wealthy—it’s for anyone who wants to protect their family, preserve assets, and ensure their wishes are carried out.

Comprehensive reviews of existing plans

Life doesn’t stand still—marriages, moves, milestones, business sale, and finances all change. Your estate plan should grow with you.

Reduce Taxes. Protect Assets. Build Legacy.

A smart estate plan reduces taxes, avoids probate costs, and preserves more of what you’ve built. With tools like trusts, gifting strategies, and tax-advantaged accounts, you can protect your assets and ensure they grow into a lasting legacy for your family.

the importance of Estate Planning for everyone

More reasons to create an estate plan

Avoid Probate

Avoiding probate saves your family time, money, and stress, while keeping your affairs private. Without estate documents, you could have your affairs made public record

Power of Attorney and Healthcare Directives

Whether you want to protect your partner, parent or adult child, creating a POA or healthcare directive is a simple way to save time and money in a difficult time.

Scenario planning

Life is unpredictable—marriages, children, financial changes, health events, even new laws can all impact your plan. Scenario planning prepares for the “what ifs,” ensuring your estate plan adapts and protects your wishes no matter what happens.